Qr Merchant Meaning

The easiest example of NFC-based mobile payments is Apple Pay. Moreover it also means that the person who sends the QR code has more control over the payment amount.

How Qr Code Payments Work All You Need To Know In One Guide Tranzzo

Through DuitNow QR consumers can make payment from any participating Banks or e-Wallets mobile apps.

Qr merchant meaning. They link merchants with issuing banks those that issue credit and debit cards to consumers. Kung merchant ka ibig sabihin kada bayad sayo gamit scan to pay QR mo may kaltas na yun dapat. The customer will.

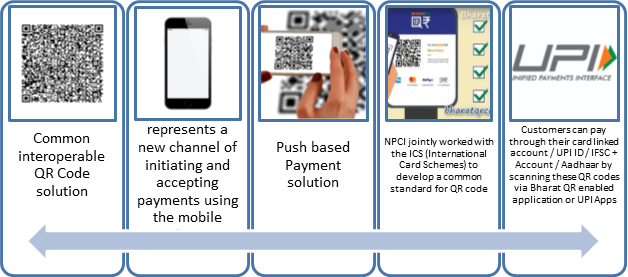

This can be confusing for consumers who have. It either opens a payment link confirms payment or does any other operation as specified. Bharat QR refers to QR code based acceptance solution provided by SBIP to its merchants for accepting payment from their Customers by scanning of QR code using Bharat QR customer app or UPI app.

What does the QR in QR code stand for. A QR code is the abbreviation of Quick Response code a trademark name of the most popular type of 2D barcode readable by smartphones. It is a single standardised QR code for e-payments and combines multiple payment schemes into a single SGQR label.

What is an Acquirer. Merchant means the store or vendor who sells goods or services and accepts Smart QR payments. According to this command the QR code is generated.

In particular interoperability is a crucial requirement for the industry to achieve a harmonised customer experience for QR code merchant payments driving customer adoption. A customer uses their phone to scan the QR code and completes the payment on the spot. These codes can either supplement in-store retail or bolster security and ease of use for in-app or app-to-app purchases.

This type of payment functions like a normal POS terminal. This is an alternative to doing electronic funds transfer at point of sale using a payment terminal. SGQR is not a separate payment scheme or payment app.

What is a merchant QR code. Mobile payments mean making payments in-store using a smartphone. QR payments bypass a lot of the traditional clunkiness of payment systems.

Merchants would only need to display one QR Code thus lessening confusion amongst consumers. The customer just has to scan it and then transfer payment. Paydiant a startup based in Newton Mass provides the technology behind the app and partnered with Merchant Customer Exchange a consortium of retailers to create it.

Currently consumers may see multiple QR codes at merchant stores promoting various e-payment solutions. Consumers using the app can pay using a QR code Bluetooth or a numeric code that is generated through the app on their phone upon checkout. It is intended to simplify QR e-payments in Singapore for both consumers and merchants.

As a result of this feature the user has to just accept the transaction in their application. Dengan mengakses situs ini Anda telah menyetujui penggunaan cookies dari. An acquiring bank acquirer works as the middleman in payment card transactions.

INTRODUCTION Quick Response QR code based payment solutions initiated using mobile devices provide an alternative channel for initiating and accepting payments specifically between a customer and a merchant. QR stands for quick response and its a form of contactless payment where a user scans a quick response code from an app on their phone functioning a lot like a barcode. The QR stands for quick response.

Payment can be accepted from the customer of any Bank having Bharat QR customer app or. This avoids a lot of the infrastructure traditionally associated with electronic payments such as payment cards payment networks payment terminal and. Dynamic QR codes are now widely used by the merchants as it conveys both the purchase amount as well as the merchant information.

SGQR is a single QR code that combines multiple e-payment solutions into one. The SGQR scheme is co-owned by MAS and IMDA. A merchant QR code is a code generated by a merchant for the purposes of processing payments or sales.

The merchant has a screen that shows the QR code and the GCash user simply scans that and confirms payment in the app to proceed. Situs ini menggunakan cookies untuk memberikan pengalaman browsing yang terbaik. Challenges with NFC-based Mobile Payments.

Consumers just need to look out for the SGQR label to see which payment options a merchant accepts while merchants only need to display one SGQR label instead of many labels. Below are some examples from the EMV Merchant-Presented QR Guidance and Examples document. To scan QR codes you will need A barcode reader QR scanner.

Customer means the wallet user of PSPs and bank app users who can scan Smart QR and make payments. An example merchant is SM Department Stores Supermarkets. But this mode of mobile payments has not been able to take.

EMV merchant-presented QR codes can be used in different C2B scenarios. Scan to pay via Customer Presented QR Code Generate Code. QR code merchant payments present a significant but potentially complex opportunity for MMPs and the challenges and strategic benefits must be considered carefully.

QR codes are presented as a barcode-looking image that contains information on both the merchant and payment provider. When a QR code is scanned the horizontal and vertical patterns of the matrix are decoded by the software on your smartphone and converted into a string of characters. Or the newer Android Pay by Google.

Buyers can make in-store mobile payments in two waysNFC and QR Code payments. Bharat QR is interoperable amongst Banks and major Card schemes. There is also a new type of Scan QR Code which is the dynamically generated QR code.

Merchant can generate QR codes for his shop or for any fixed or variable amount. The merchant-presented QR Code enables consumers to make purchases using a merchant generated and displayed QR ode based on the merchants details. QR code payment is a contactless payment method where payment is performed by scanning a QR code from a mobile app.

While issuing banks work directly with cardholders acquirers provide the financial backing and infrastructure for merchants to accept credit cards. Transaction means an electronic financial transaction carried out using the Smart QR Services. With the new payment option for AUB PayMate merchants customers only need to use a smartphone camera to scan the card QR code displayed at the AUB PayMate merchants stores.

All a customer has to do is scan their QR code confirm the amount requested and then submit the payment.

Bharat Qr Code Pay Merchants With Qr Code Npci

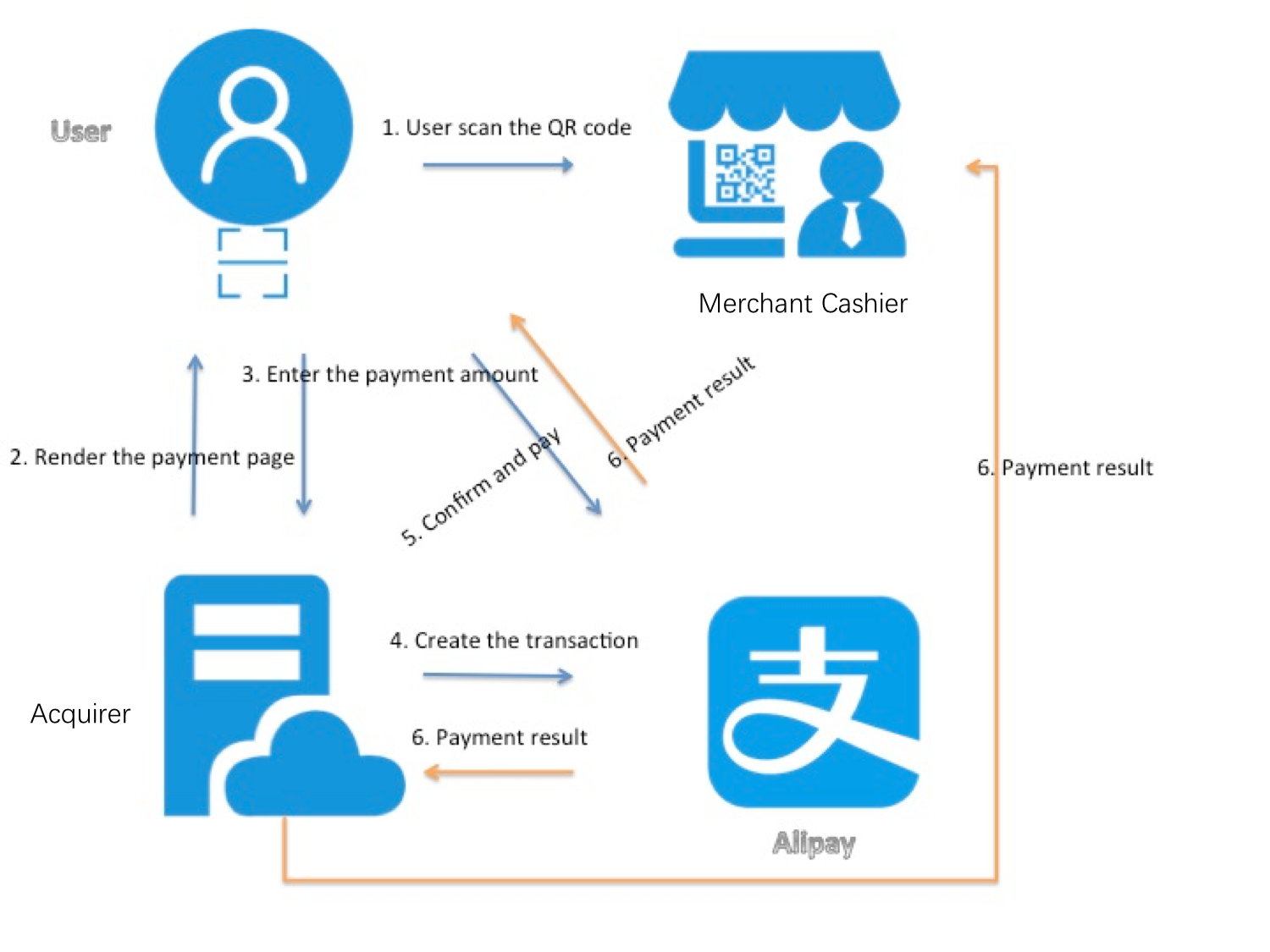

Introduction Third Party Merchant Qr Code Payment New Alipay Docs

Verifying A Disputed Visa Transaction Visa Contact Card Card Holder

Posting Komentar untuk "Qr Merchant Meaning"